One of the things I think I try to do in this blog is look towards the longer-term, a position that's popular with all so-called "value" investors. It means being able to ignore seemingly unfavorable current issues (particular security price declines), and look towards a more long-term favorable future.

One of the things I think I try to do in this blog is look towards the longer-term, a position that's popular with all so-called "value" investors. It means being able to ignore seemingly unfavorable current issues (particular security price declines), and look towards a more long-term favorable future.I have written about my belief that the emerging markets will continue to outperform over the longer term, given the improvements in the economies, currencies, governments in many of those countries, and their long-term growth profile. Add to that what I believe is a secular trend to a decline in the value of the US currency, the case for long-term emerging markets investing seems made - to me. Nevertheless, it's days like today that take a strong belief in that position and the ability to stand fast in the face of the storm.

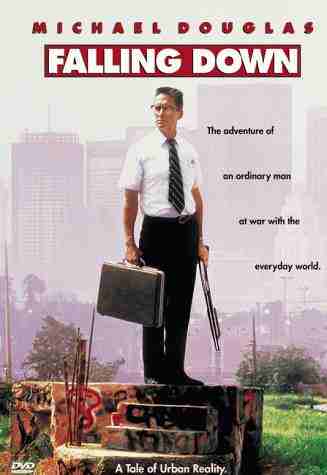

Here's how some of the iShares ETFs are standing up (or falling down) today as of this writing (1PM Eastern time):

- Brazil -7.86% (EWZ)

- S. Korea -6.77% (EWY)

- Taiwan -6.21% (EWT)

- S. Africa -5.86% (EWA)

- Emerging Markets (general) -5.66% (EEM)

- Japan -3.66% (EWJ)

- United Kingdom -2.59% (EWU)

- Germany -2.21% (EWG)

- S&P350 Europe -2.81% (IEV)

- S&P500 -0.73% (SPY)

JW

The Confused Capitalist

No comments:

Post a Comment